- In 2025 alcoholic beverages sold online are projected to account for around 6% of all off-trade volumes, it was less than 2% in 2018

- In 2021 about 25% of alcohol drinkers worldwide declared buying alcohol online, and about 16% made their first purchase before the pandemic

- The USA, thanks to annual growth of around + 20%, will be the country on the top of the global online alcohol market. The USA has the highest percentage of online shoppers who made their first purchase during the pandemic: 54%

- China, which currently accounts for 1/3 of total e-commerce value, is expected to expand less rapidly. China has the highest percentage of online alcohol shoppers: nearly 60%

- In most markets, wine is the leading alcoholic beverage category in e-commerce, accounting for around 40% of total value (with notable exceptions in China, Colombia, Mexico and Nigeria, where spirits drive online sales. by value)

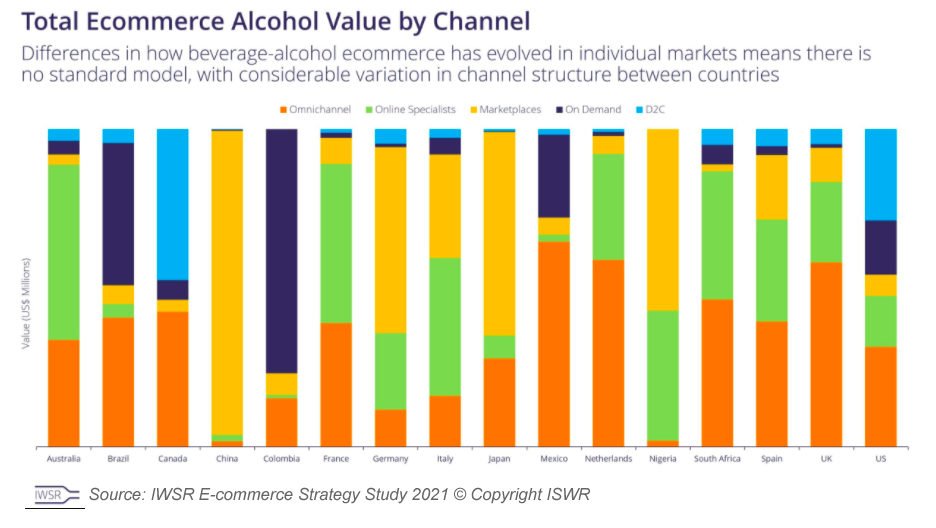

Alcohol e-commerce will continue to grow, but there is no standard model. Significant differences in business models are developing in the 16 key markets studied by ISWR. Alcoholic beverages e-commerce is divided into two distinct but sometimes overlapping models:

- a more “traditional” e-commerce – often omnichannel accessed via websites, used by older consumers who are looking for good prices and known brands and are ready to wait for delivery

- a more “modern” app-based e-commerce – often on-demand or marketplace – used by younger consumers who are looking for interesting and premium brands and are willing to pay for fast delivery

Analysing the ISWR graph we can note:

- The Direct 2 Consumer channel is predominant in Canada and the USA and marginal in all other countries

- Sales through the Marketplace channel are largely dominant in China and Japan